Employment Situation Report – January 2021

Summary of the Bureau of Labor Statistics Monthly Employment Situation Report

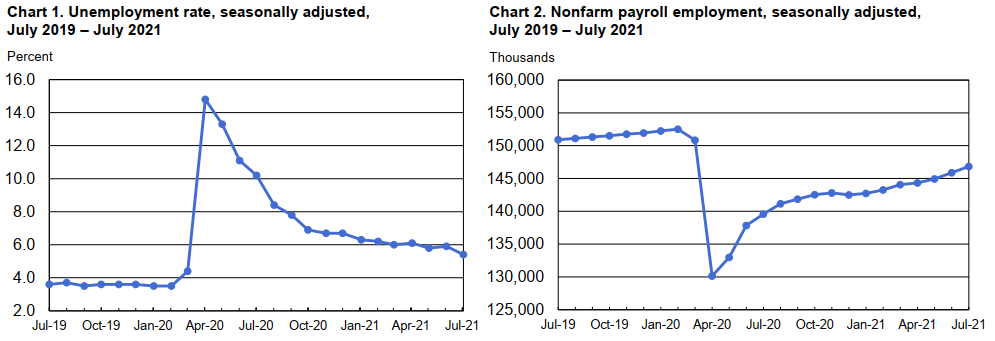

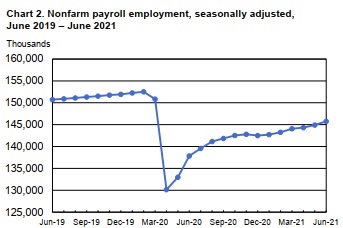

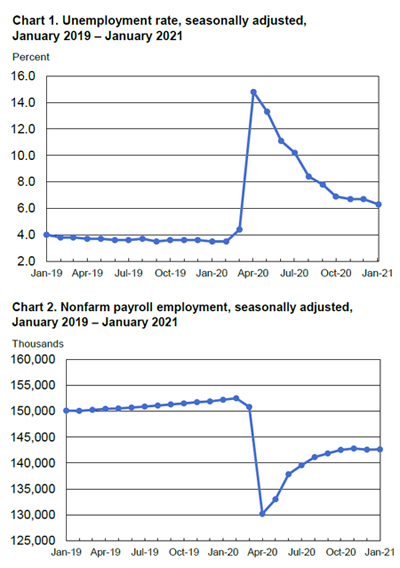

The January job gain of 49,000 was in-line with most analysts’ expectations and represented an improvement over the weak December Bureau of Labor Statistics (BLS) report. Unemployment rate fell by 0.4 percentage point to 6.3% in January or 10.1 million unemployed persons.

The BLS noted the labor market continued to reflect the impact of the coronavirus pandemic and efforts to contain it. However, the data suggests that the impact of the virus might be lessening; the sharp rate of decline in the large leisure and hospitality sector moderated as government mandated restrictions eased during January.

As noted in the Wall Street Journal today many economists expect the economy could benefit from further government stimulus. Congress is considering as much as $1.9 trillion in additional financial aid to help households and businesses. The proposal would bolster unemployment aid, provide funds for vaccine distribution, and send $1,400 checks to many Americans.

“The resiliency of the U.S. labor market and overall economy is reflected in today’s BLS Employment Situation Report. Our clients’ hiring activity in many sectors of the economy demonstrates that same resiliency as talent consultants from our Network of over 300 executive recruitment offices continue to see solid demand for executive and managerial talent across technical and professional roles,” said Bert Miller, President and CEO of MRINetwork (ETS Dental is a franchise office). “But, as demonstrated in today’s BLS data, the job recovery remains uneven in the white-collar roles where much of our Network focuses. I urge political leaders to avoid a ‘government knows best’ solution as they design stimulus programs. It is vital to include input from the people driving private-sector hiring that will propel the economy to new heights.”

Dental Employment Report

ETS Dental’s team has seen a marked rise in the number of practices reaching out to us for Associates and Managers at the office, regional, and corporate levels. Many noted the better than expected finish to 2020. Additionally, they are optimistic about the increased demand for dental services in 2021 due to vaccinations.

We expect to see a rapid increase in the hiring of Dentists and Operations Professionals throughout Q1 & Q2. Practice owners and managers are strongly encouraged to start their talent searches as early as possible and prepare to be competitive in pay and benefits. Dental professionals at all levels have a lot of choices.

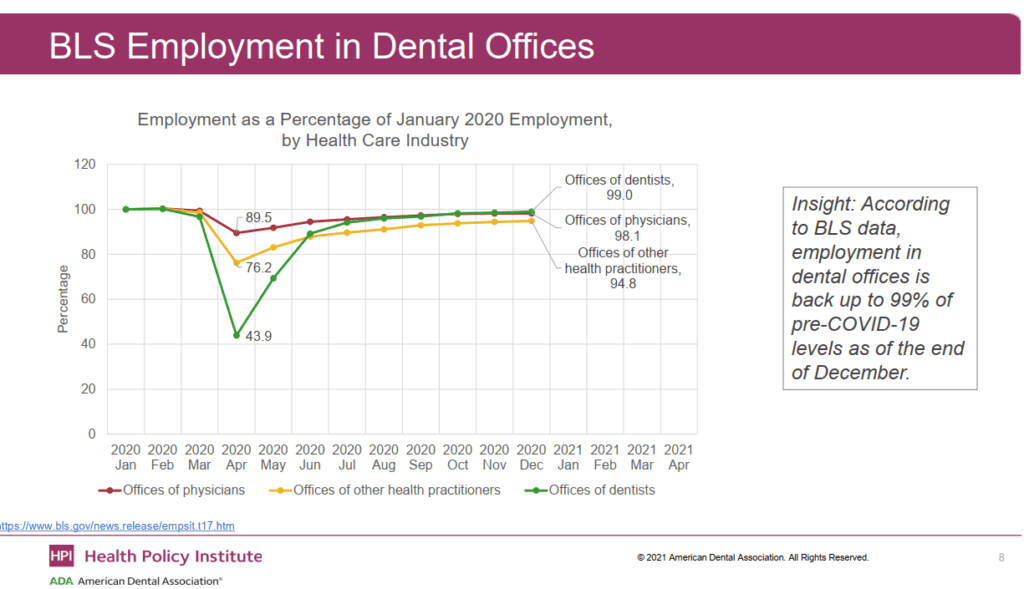

- 43% of practices report “business as usual.” This has steadily improved over the past 3 months. 99% of practices are now open and have been for many months.

- Patient volume has ticked up to 80% of pre-COVID numbers. Look for this to start increasing more dramatically.

- Overall dental employment is 99% of pre-COVID levels, which means anyone who wants a job in dentistry can likely find work.

- The ADA’s analysis of non-owner dentists being paid show’s that only 80% of dentists are reporting being fully paid. This is more likely a result of dentists not wanting to work or delays in payment for services rendered rather than an unemployment issue.

Source and full reporting can be found at the ADA HPI resource: COVID-19 Economic Impact on Dental Practices

The BLS reported that in January, 23.2 percent of employed persons teleworked because of the coronavirus pandemic, slightly below December rates. These data refer to employed persons who teleworked or worked at home for pay at some point in the last four weeks specifically due to the pandemic.

In assessing today’s BLS report Dan North, senior economist at Euler Hermes North America saw signs of momentum. “It may be a few months before warmer weather, less COVID-19, and more consumer confidence encourages consumers to go on a shopping spree which will provide the real stimulus and job creation.”

As reported by the BLS, in January employment in professional and business services rose by 97,000, with temporary help services accounting for most of the gain (+81,000). Job growth also occurred in management and technical consulting services (+16,000), computer systems design and related services (+11,000), and scientific research and development services (+10,000). These gains were partially offset by job losses in services to buildings and dwellings and in advertising and related services.

Employment increased in local government education (+49,000), state government education (+36,000), and private education (+34,000). The BLS noted that in both public and private education, pandemic-related employment declines in 2020 distorted the normal seasonal buildup and layoff patterns. This likely contributed to the job gains in January.

Wholesale trade continued to add jobs in January (+14,000) as did mining with a gain of 9,000 jobs.

As previously noted, employment in leisure and hospitality declined by 61,000, following a steep decline in December (-536,000). In January, employment edged down in amusements, gambling, and recreation (-27,000) and in accommodation (-18,000). Employment in food services and drinking places was down (-19,000).

Retail trade lost 38,000 jobs in January, after adding 135,000 jobs in December.

Employment in healthcare, transportation and warehousing, manufacturing, and construction changed little versus the prior month as did jobs in other major industries, including information, financial activities, and other services.

“A critical need is to prioritize upskilling talent as today’s businesses deal with fundamental changes to the world of work spurred by digital transition. Our most successful clients are investing in their current workforce to make them better performers today. More importantly, they are anticipating the new skills their existing teams will need to thrive in future.

“That same model should apply to governmental stimulus programs. They should encourage every company to invest capital into upskilling their current workforce while providing added help to the most impacted industries like hospitality, travel, and traditional retail as they adjust to a new world of contactless purchasing, off-premises consumption, and automation that adds new value to the consumer experience. Provide the stimulus to the businesses who are at the front line of transformation and let the recovery accelerate,” noted Miller.

Download the full report below: